CertifID, a startup creating fraud prevention tech for the actual property market, at this time introduced that it raised $20 million in a funding spherical led by Arthur Ventures at “over double” its earlier valuation.

CertifID primarily develops merchandise to combat wire fraud. The startup’s co-founder, Thomas Cronkright, launched the corporate in 2017 after shedding $180,000 to fraud at his actual property title company in Grand Rapids, Michigan.

Usually, in wire fraud involving actual property transactions, criminals discover details about upcoming actual property closings by hacking into e mail accounts — usually potential owners. Posing as respectable reps of economic establishments, they e mail homebuyers fraudulent wire switch directions.

Greater than 13,000 individuals had been victims of wire fraud in the actual property and rental sector in 2020, with losses of greater than $213 million — a rise of 380% since 2017, according to FBI information.

Cronkright later teamed up with Tyler Adams, a former lead product supervisor at BCG’s company funding and incubation division, to construct a platform to guard dwelling consumers, dwelling sellers and actual property companies from this type of cybercrime.

“The actual property business is dealing with a wire fraud downside that has accelerated considerably in recent times,” Adams, who serves as CertifID’s CEO, instructed TechCrunch through e mail. “The FBI lately reported sufferer losses from real estate business email compromise increased 72% from 2020 to 2022 … CertifID was created to assist create a world with out wire fraud.”

A “world with out wire fraud” is a tad hyperbolic. However CertifID does provide instruments to combat it.

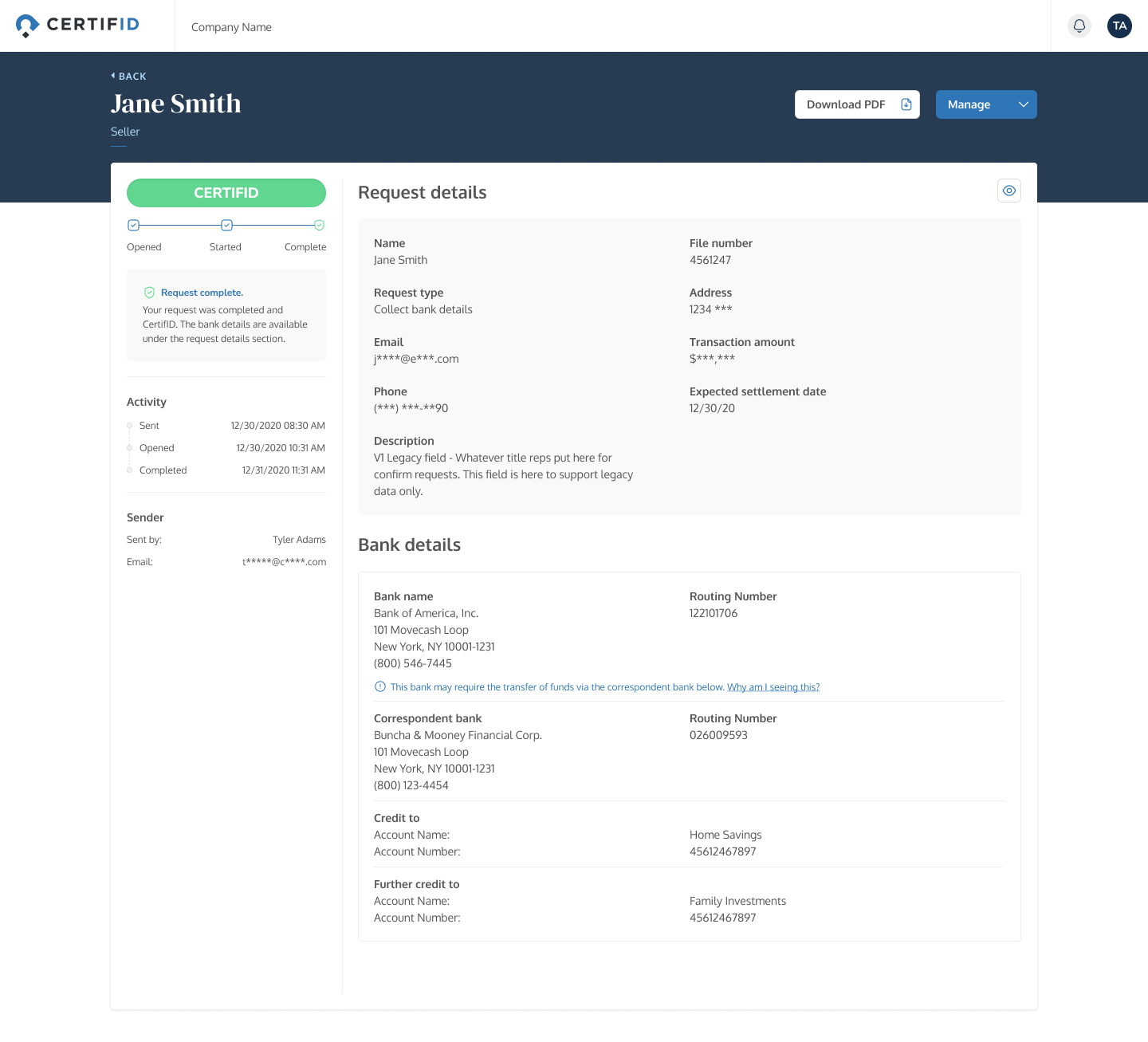

For title brokers and actual property legislation companies, CertifID handles transactions, insuring as much as $1 million each time cash adjustments fingers. House consumers obtain wiring directions and are given the choice to buy a cash safety plan for added protection. In the meantime, dwelling sellers are requested to offer banking data and undergo an identification verification course of to stop fraud makes an attempt.

Underneath the hood, a rules-based engine together with an AI mannequin skilled on “internally vetted information,” “professional selections” and evaluations of its personal selections powers CertifID’s cost disbursement and identification verification processes. (This reporter wonders in regards to the high quality of that information, however CertifID didn’t go into nice element.) The mannequin evaluates numerous markers of fraud, incorporating new information factors as malicious actors embrace new approaches.

“We consider automation and AI have unimaginable potential to the market,” Adams mentioned. “However we additionally acknowledge that fraud and abuse of belief leverage the human components of know-how disproportionately, and method the issue of fraud with a human-centered method.”

With the brand new funding, CertifID says that it plans to assist ongoing product improvement and scale operations to fulfill demand for its merchandise. CertifID claims to have “a number of hundred” title and actual property enterprise clients and partnerships with federal legislation enforcement to assist fraud restoration efforts the place its verification software program isn’t used.

CertifID’s administration dashboard for wire fraud prevention.

Thus far, CertifID has raised over $40 million — a mixture of fairness and debt.

“Regardless of a downturn within the housing market, CertifID continued to see elevated demand in its services and products,” Adams mentioned. “Fraud has continued to extend by means of a pandemic, a financial institution disaster and ongoing twin threats of inflation and recession. And it’s anticipated to proceed to rise into the foreseeable future. With the vast majority of the actual property business but to undertake anti-fraud know-how, the corporate expects continued progress forward.”