Artificial intelligence is a game-changer for finance teams. If you’re not using AI tools for accounting tasks, you’re making things more complicated than they need to be.

AI accounting tools can save you time and money while improving business performance. It automates repetitive tasks so you can put your brainpower into more important things like decision-making. 🤠

Ready to let accounting automation transform your workflow? Here are the 10 best AI tools for accounting and finance to get you started.

How Is AI Used in Accounting?

Accounting firms have long used data entry software to reduce human error and improve profitability. When you add AI technology to the mix, magic happens.

Accounting is all about calculations, mathematics, regulated processes, and tax compliance. Those are some of the things automation software does best.

AI accounting software allows accountants to put tedious tasks on autopilot and improve their financial operations. Here are some of the many benefits AI brings to accounting processes:

- AI-powered data prediction

- Faster financial data analysis thanks to advanced algorithms

- Improved financial report accuracy

- Lightning-fast automated invoice processing

- Real-time insights and alerts

- Reduced manual data entry

- Scalability without an increase in manual work

What to look for in an AI tool for accounting

AI tools for accounting provide indisputable benefits, from improving financial insights to automating time-consuming tasks. It’s all about identifying what you’re looking for and finding the right tool.

Everyone from freelance CPAs and startups to Fortune 500 CFOs and large accounting firms can use features like these:

- Automated bookkeeping: AI tools should automate bookkeeping tasks to help you save time, make better decisions, improve expense management, and reduce financial statement errors

- Automated invoice processing: Good AI-powered accounting software can automate payments and invoices to improve expense reports

- Integrations: AI accounting tools that integrate with your other software—from Slack to QuickBooks—make life easier

- Machine learning: Leading AI tools use machine learning algorithms to assess mathematical models and improve processes without instruction; it’s an accounting industry must-have

- Templates: When manual work is required, a good tool can speed it up with bookkeeping templates, payroll templates, and general ledger templates

10 Best AI Tools for Accounting 2023

The hardest part of finding an AI tool for accounting is sifting through all the options. We’ve narrowed it down to the top 10 tools in 2023.

With this list, you can assess each tool based on the best features, limitations, pricing, and reviews to make the right choice.

1. ClickUp

ClickUp Accounting is a cloud-based business management software designed to simplify financial processes. Manage accounts, create shareable reports, and let ClickUp AI act as your own digital personal assistant so you can focus on the larger strategy at hand.

ClickUp AI uses natural language processing to help with everything from financial management to client check-ins. We’ve built hundreds of AI tools for every aspect of your accounting system.

You can also use ClickUp Docs to create spreadsheets and explore templates for all things finance.

For example, the ClickUp Accounting Template is designed to help manage your invoices, sales records, income, and predicted revenue. Keep up with accounts receivable and accounts payable (AR/AP) and use resource tracking to improve overall financial performance.

ClickUp has over 1,000 ready-made integrations with other tools to keep everything in one convenient, customizable Dashboard.

ClickUp best features

- Choose from hundreds of templates to help with everything from budget and cash flow management to project management

- Use AI to summarize financial planning meetings, connect with clients, outline audit policies, update sales forecasting reports, and more

- Choose from over 100 ClickUp Automations to put back-office tasks on autopilot

- Make informed decisions and improve your business’s financial health with help from ClickUp’s ChatGPT Prompts for Finance

- Switch between multiple views, create custom Dashboards for every team member, and use project time tracking to streamline your workflow

ClickUp limitations

- Some users may face a learning curve with ClickUp’s many features and functionalities (we’ve solved this with free video tutorials for almost everything)

- ClickUp AI isn’t available on the Free Forever plan

ClickUp pricing

- Free Forever

- Unlimited: $7/month per user

- Business: $12/month per user

- Enterprise: Contact for pricing

- ClickUp AI is available on all paid Workspace plans for $5 per member per month

ClickUp ratings and reviews

- G2: 4.7/5 (8,800+ reviews)

- Capterra: 4.7/5 (3,800+ reviews)

2. Vic.ai

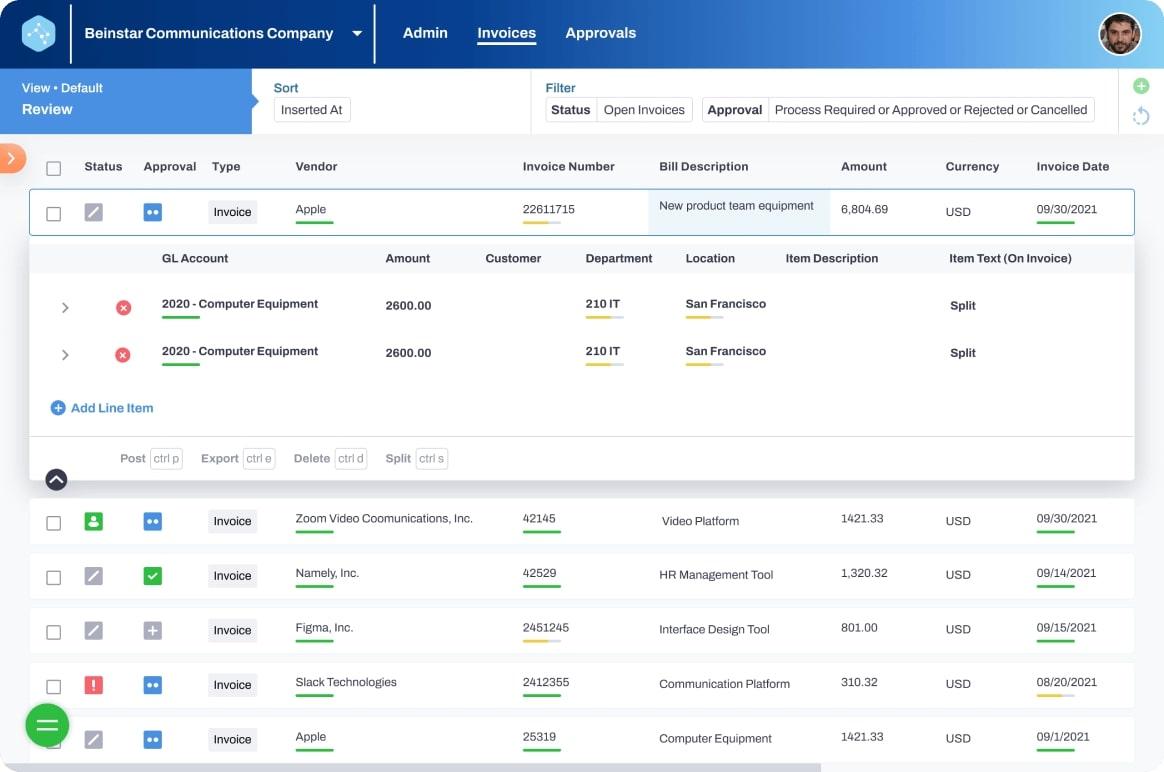

Vic.ai is an AI-powered invoice processing tool with high accuracy rates and advanced machine learning algorithms. It uses powerful algorithms trained on millions of invoices to automate almost every aspect of billing without the need for templates or custom rules.

Once an invoice is uploaded, Vic.ai can extract essential details from invoices, detect duplicates, and put the approval process on autopilot. It also keeps your team on track by identifying which employee needs to review each step of the invoice approval process.

Vic.ai best features

- Use integrations with leading enterprise resource planning (ERP) tools to automatically sync financial data

- Reduce human error by allowing Vic.ai to identify and flag duplicate invoices and other accounting mistakes

- Automatically recognize, code, and calculate value-added tax (VAT) and other taxes to improve accuracy and tax compliance

- Improve financial decision-making using insights and analytics based on your accounting firm’s latest data

Vic.ai limitations

- No visible pricing information; some customers report that the tool is expensive for freelance accounting professionals and small businesses

- Reviews mention a need for additional sorting and report options to improve efficiency

Vic.ai pricing

- Customers must contact Vic.ai and provide business information to request a price quote

Vic.ai ratings and reviews

- G2: 4.8/5 (20+ reviews)

- Capterra: N/A

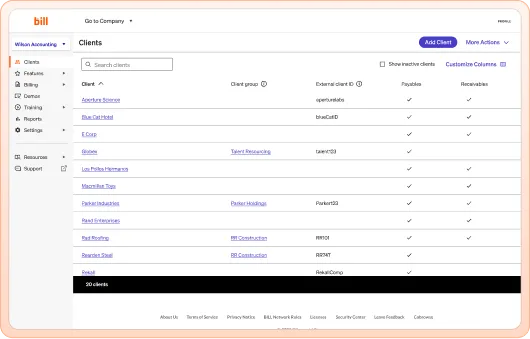

3. Bill

Bill is a cloud-based tool that automates AR/AP processes. It’s designed for accounting firms and businesses that want to streamline the billing and invoicing process.

Users also gain access to Divvy From Bill, an automated credit and expense management software, at no extra charge. Divvy offers lines of credit up to $15 million and tools to help control budgets and manage spending.

Bill best features

- Use smart rules and workflows to automate bill payments and approvals

- Control spending across teams, projects, departments, and vendors with increased visibility

- Get cash-back rewards for eligible purchases made with Divvy lines of credit

- Navigate multiple clients with ease to process AP invoices, approval, and payments

Bill limitations

- May charge fees from some services and individual transactions

- Bill does not provide support for all credit cards, payment methods, and currencies

Bill pricing

- Essential: $40/month per user

- Team: $55/month per user

- Corporate: $79/month per user

- Enterprise: Contact for pricing

Bill ratings and reviews

- G2: 4.3/5 (600+ reviews)

- Capterra: 4.2/5 (200+ reviews)

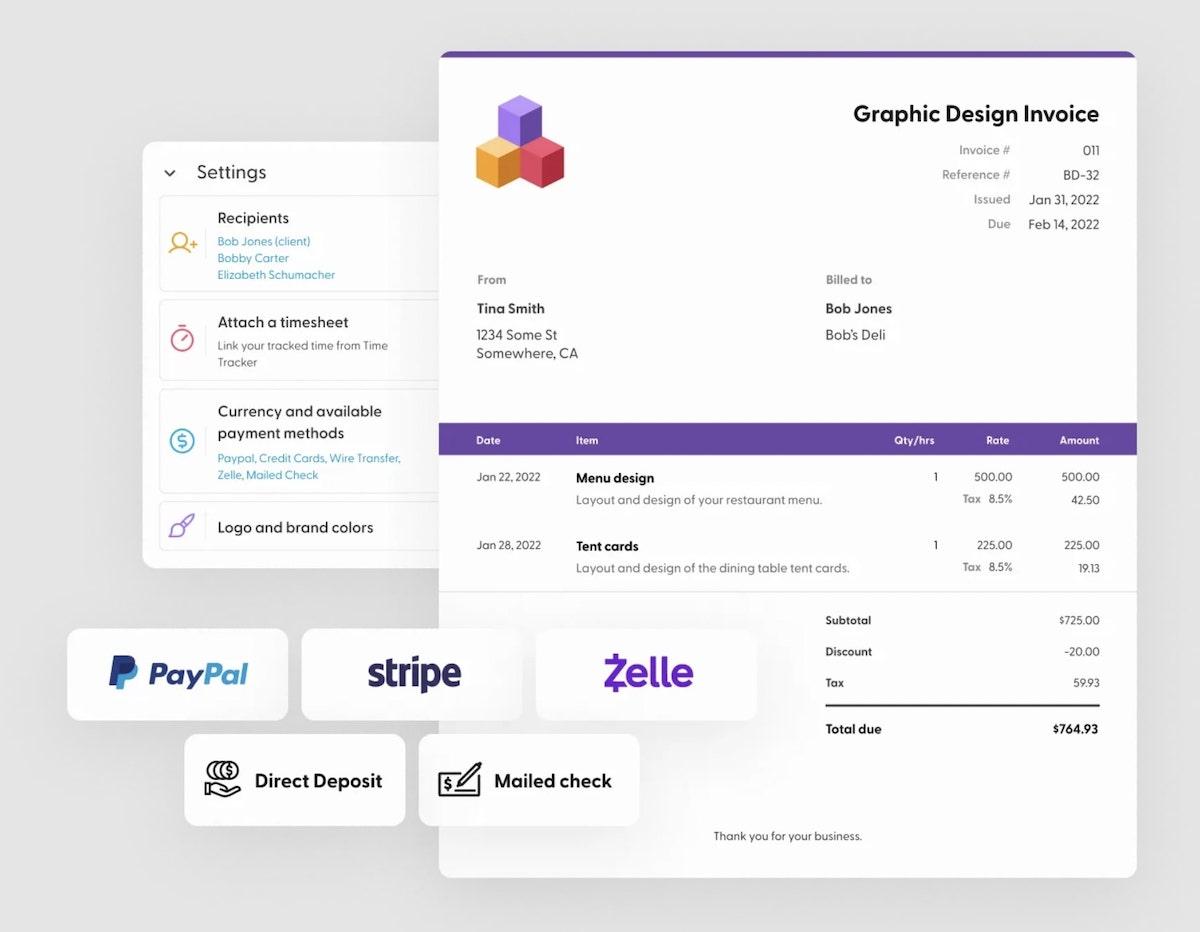

4. Indy

Indy is an AI workflow and admin program designed for independent professionals. It allows freelancers to create proposals, draft contracts, send invoices, and—most importantly—get paid. 🤑

With Indy, you can track your time for effortless billing, negotiate the terms of your contract, store files, and run your business from one convenient dashboard.

Indy best features

- Take advantage of the free plan and get unlimited access to basic features with limited access to advanced functionality

- Let the Indy AI writing assistant help you create contracts and proposals using ChatGPT technology

- Unify your work using the app’s integration with Zapier and Google Calendar (paid plan only)

- Set up recurring invoices, offer multiple payment options, set tax rates, and keep track of every transaction to ensure tax compliance

Indy limitations

- Free plan limits users to three clients

- Some user reviews report inaccuracies when manually tracking time

Indy pricing

- Free

- Pro: $12/month per user

Indy ratings and reviews

- G2: N/A

- Capterra: 4.7/5 (100+ reviews)

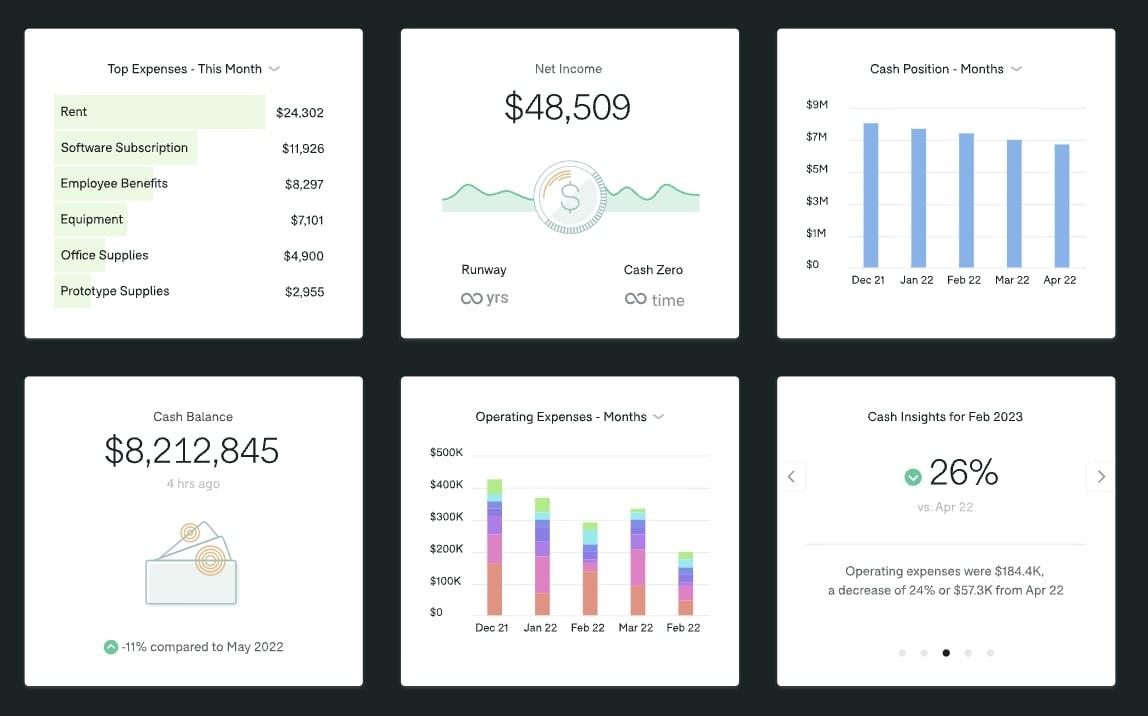

5. Zeni

Zeni uses AI to automate accounting, spending, and budgeting processes to streamline financial operations. It provides real-time financial data analysis to improve business decisions, integrating AI with human knowledge for the most effective information.

Use Zeni to automate the time-consuming daily expense tracking and bookkeeping procedures.

Zeni best features

- Get a top-down perspective on your financial operation using the one-page view

- Compare monthly, quarterly, and yearly reports to track financial progress and identify trends

- Extract necessary data from receipts and forward it to a dedicated email address for consolidation and record-keeping

- Improve communication and information sharing between multiple teams with automatic updates and notifications

Zeni limitations

- Some user reviews mention a need for more guidance regarding how to review and process data to improve decision-making

- May be expensive for some freelancers, entrepreneurs, and startups

Zeni pricing

- Starter: $549/month per month billed annually

- Growth: $799/month per month billed annually

- Enterprise: Contact for pricing

Zeni ratings and reviews

- G2: 4.7/5 (20+ reviews)

- Capterra: N/A

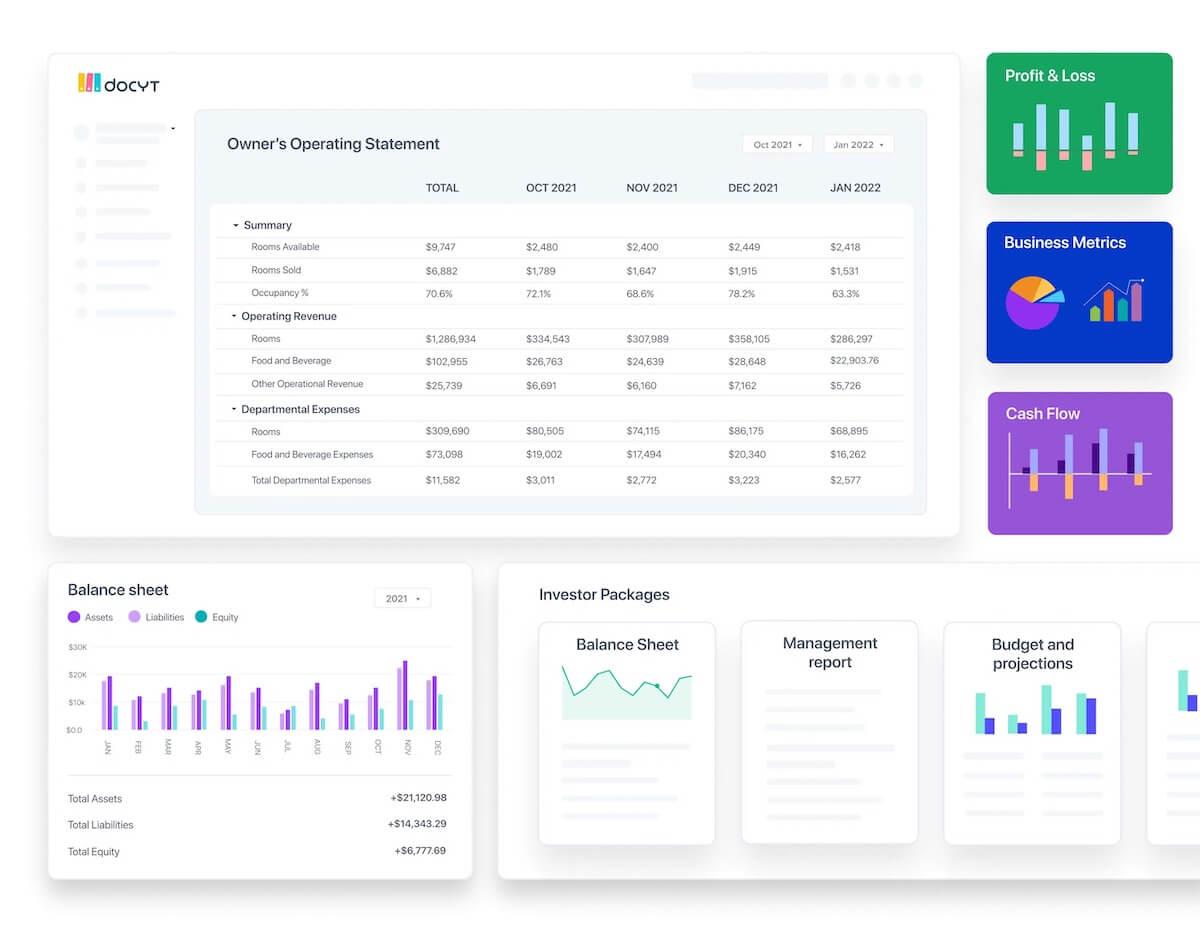

6. Docyt

Docyt is an AI-powered bookkeeping platform designed to automate back-office and accounting tasks. Gain insight with real-time reports and ensure financial control over all aspects of your business.

Docyt also allows you to keep all critical financial information and documents in one secure place and create separate vaults for different projects or businesses.

Docyt best features

- Multiple plans to suit various needs, from expense management to automated bookkeeping for large operations

- The mobile app is easy to use and navigate, providing secure, on-the-go financial tools and information

- Use the expense tracking feature to track and control your business’s budget and cash flow

- Integration with most major POS and PMS systems to provide industry-specific reporting

Docyt limitations

- Some user reviews mention difficulty connecting with customer support and slow response times

- Some users mention the need for additional features to assist with accounting project management

Docyt pricing

- Expense Management: $50/month

- Revenue Reconciliation: $50/month

- Corporate Credit Card Management: $50/month

- Mini: $149/month

- Insight: $149/month

- Impact: $299/month

- Advanced: $499/month

- Enterprise: $999/month

- Accounting Firm & CFO: Contact for pricing

Docyt ratings and reviews

- G2: N/A

- Capterra: 4.6/5 (30+ reviews)

7. Gridlex

Gridlex is a unified suite of business tools that includes Gridlex Sky. Sky is an accounting, expenses, and ERP software created by Gridlex to make financial processes easier.

Use Gridlex Sky to oversee all accounting, expense management, and ERP functions with customizable automations and AI-driven insights. Sky can handle invoicing, billing, payroll, general ledger management, and more.

Gridlex best features

- Gridlex Sky users also receive access to Gridlex Ray, an HR software, and Gridlex Zip, a CRM and customer service help desk tool

- Eliminate the need for manual work and reduce the risk of human error with automated calculations for profitability, revenue, and expenses

- Use the expense management feature to organize and store receipts and expense claims through a straightforward interface

- Automate expense approvals and reimbursements to reduce administrative processing

Gridlex limitations

- Lack of customer reviews on popular platforms makes it difficult to gauge the overall user experience

- Advanced features such as revenue recognition automation are not available on the first pricing tier

Gridlex pricing

- Start: $10/month per user

- Grow: $30/month per user

- Scale: Contact for pricing

Gridlex ratings and reviews

- G2: N/A

- Capterra: N/A

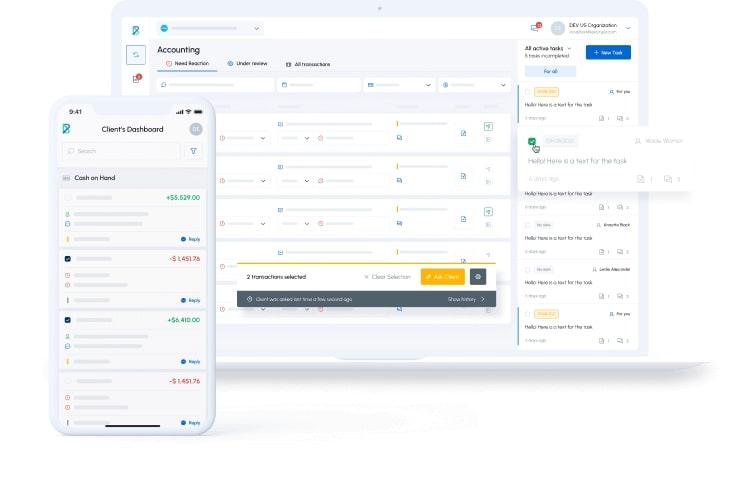

8. Booke

Booke is a bookkeeping automation tool that makes daily accounting tasks easier. It uses AI technology to reconcile errors and provide real-time data extraction. The more you use it, the better the AI becomes.

Get faster client responses and avoid tedious back-and-forth communication with Booke’s user-friendly messaging portal.

Booke best features

- Leverage AI to resolve coding errors, categorize transactions, communicate with clients, and automate your work

- Increase efficiency with AI-powered automation for month-end close tasks

- Find and fix errors in seconds with Booke’s advanced error detection features

- Integration with popular tools like QuickBooks and Xero lets you sync your financial data

Booke limitations

- Lack of user reviews on popular platforms makes it difficult to make a decision based on general customer experiences

- A minimum of five clients for each pricing tier

Booke pricing

- Smart: $10/month per client

- Premium: $20/month per client

- Enterprise: Contact for pricing

- Robotic AI Bookkeeper: Contact for pricing

Booke ratings and reviews

- G2: N/A

- Capterra: N/A

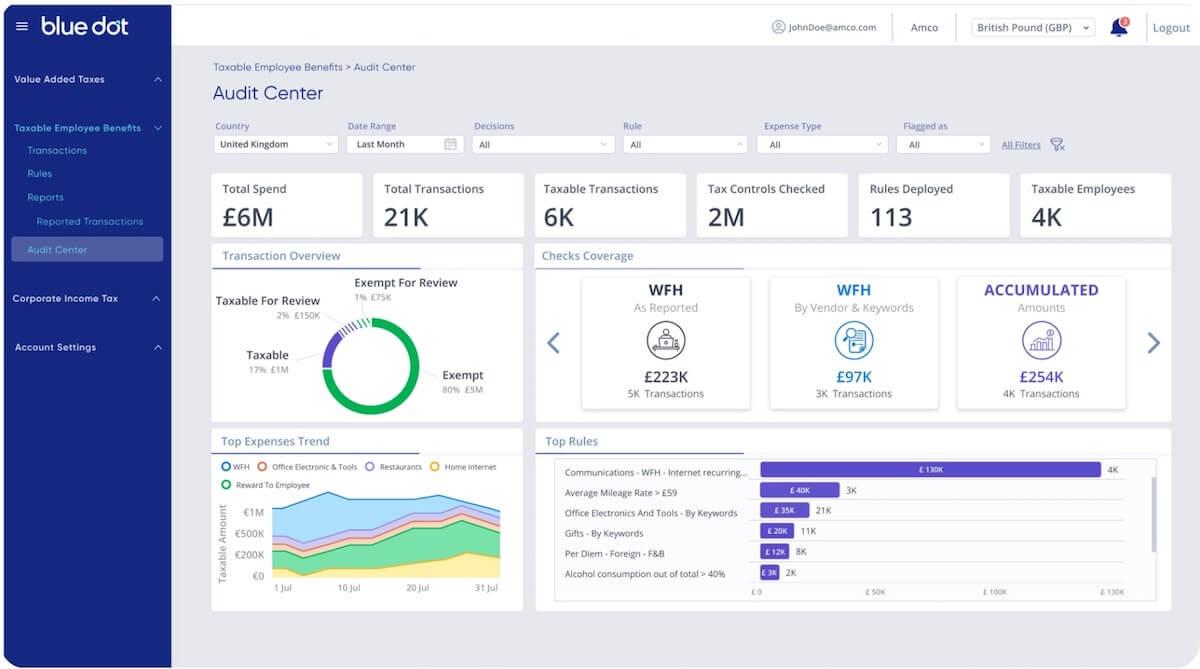

9. Blue Dot

Blue Dot is an AI tax compliance platform that uses patented technology to help businesses ensure tax compliance. Reduce tax vulnerabilities for consumer-style spending and get a 360-degree view of all employee-driven transactions.

Use the tax knowledge base to find any information you need for your business and harness the power of natural language processing to leverage external data.

Blue Dot best features

- Use VAT Box to identify and calculate any eligible or qualified VAT spending

- Let the Taxable Employee Benefits feature leverage AI to detect and analyze wage tax information

- Improve your expense management workflow and let Blue Dot’s proprietary AI-driven suite apply checks and tax rules to keep your business compliant

- Create corporate income tax reports that ensure compliance with minimal need for human input

Blue Dot limitations

- Can be challenging to get an idea of general customer experiences due to a lack of user reviews on popular platforms

- No visible pricing data

Blue Dot pricing

- Customers must contact Blue Dot and book a demo to get quotes and pricing information.

Blue Dot ratings and reviews

- G2: N/A

- Capterra: N/A

10. Truewind

Truewind is an AI-driven finance and bookkeeping platform that empowers small businesses and startups. It provides accurate monthly reports and tailored financial solutions for your industry.

Users also receive access to Truewind’s concierge team of experts to ensure precision and transparency.

Truewind best features

- Make timely, informed business decisions with faster monthly close times and efficient bookkeeping

- Contact and work with certified public accountants (CPAs) who can assist you with every step of your business’s financial processes

- Keep back-office operations accurate with minimal hands-on time so you can put your focus on growing your operation

- Simplify bookkeeping processes and integrate them with the tools you use to make financial management stress-free

Truewind limitations

- Lack of user feedback on popular review platforms

- No visible pricing and subscription data

Truewind pricing

- Customers must schedule a demo with Truewind for pricing information.

Truewind ratings and reviews

- G2: N/A

- Capterra: N/A