In today’s fast-paced business environment, managing accounts receivable efficiently can make or break an organization’s cash flow and overall financial health. Mesha, led by CEO Tahem Verma, has emerged as a groundbreaking AI-powered platform dedicated to automating finance back-office functions. At its core is Marcus, an intelligent billing assistant designed to handle invoicing, follow-ups, and reconciliation seamlessly. By addressing common pain points faced by freelancers, small businesses, and founders, Mesha has set itself apart as a leader in productivity and financial automation.

In this in-depth interview, AIPressRoom explores the vision behind Mesha, the challenges it addresses, and the transformative impact it delivers to businesses of all sizes.

Q1. Could you provide an overview of Mesha and its core functionalities? What inspired you to create a platform specifically focused on automating invoices and payment processes?

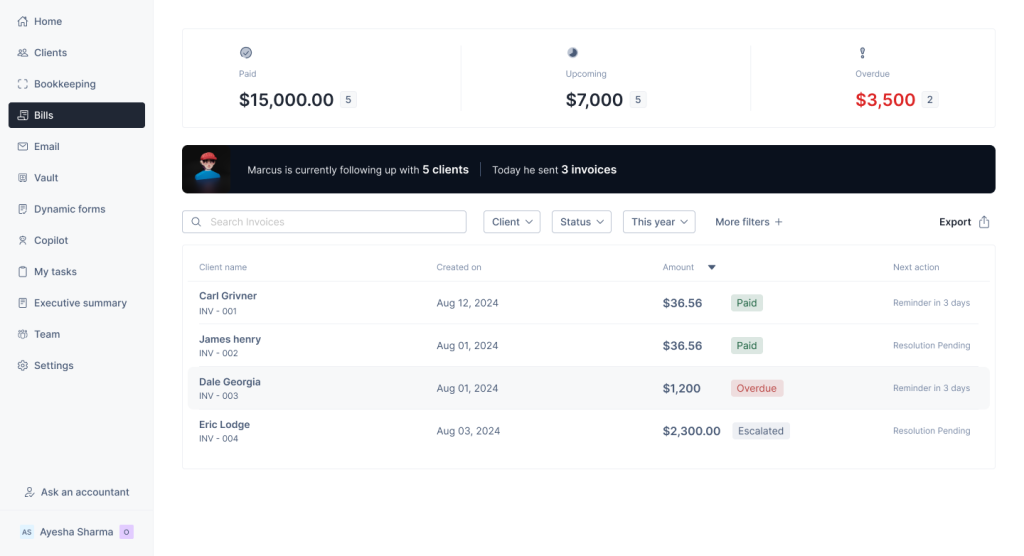

Tahem Verma: Mesha is an AI platform for your finance back office, helping automate all the finance back office functions. Our flagship product is Marcus, an AI agent that automates invoicing and following up with clients and integrates with popular accounting software like Xero and QuickBooks for auto reconciliation.

Q2. What role does Marcus, the AI billing assistant, play within Mesha? How did you decide to focus on automating invoicing as a central feature for users?

Tahem Verma: We were facing a lot of issues with getting clients to pay on time. We spent a lot of time invoicing and following up with clients. This led to not only a loss of time, delaying other crucial tasks but also made cash flow management a searing headache. Thus, we decided to build Marcus to solve our own problems. Once we implemented Marcus, our cash flow dramatically improved as clients started paying on time.

Q3. Could you explain how Marcus simplifies the invoicing process from start to finish? What are some unique AI-driven functionalities that help with client interactions and follow-ups?

Tahem Verma: Marcus, Mesha’s AI-driven billing assistant, streamlines the invoicing process from creation to payment collection. It automates invoice generation, dispatching them promptly to clients, and integrates with payment platforms like Stripe and PayPal to facilitate seamless transactions.

Marcus also manages payment reminders and follow-ups, ensuring timely payments without manual intervention. Additionally, it tracks and replies to client emails and adapts communication strategies based on their behavior, enhancing client interactions and improving collection efficiency. By automating these tasks, Marcus reduces administrative burdens, allowing businesses to focus on growth and client satisfaction.

Q4. Mesha integrates with popular tools like Stripe, HubSpot, and QuickBooks—how does this enhance the user experience? What benefits do these integrations bring to small business owners and freelancers?

Tahem Verma: Mesha’s integration with popular tools like Stripe, HubSpot, and QuickBooks enhances the user experience by creating a seamless workflow that consolidates billing, client management, and accounting processes into a single platform.

For small business owners and freelancers, these integrations offer several benefits:

- Streamlined Operations: By connecting with Stripe and PayPal, Mesha automates invoicing and payment processing, reducing manual tasks and minimizing errors.

- Enhanced Client Management: Integration with HubSpot allows for better tracking of client interactions and communications, leading to improved relationships and more efficient follow-ups.

- Simplified Accounting: Syncing with QuickBooks and Xero automates bookkeeping tasks, ensuring accurate financial records and saving time on data entry.

Additionally, Mesha provides a dedicated password-protected client portal to share documents, bank statements, and other files.

Q5. How does Mesha ensure data security and compliance, particularly with GDPR and CCPA? What measures have been taken to provide users with a secure and trustworthy platform?

Tahem Verma: We take security very seriously, and treat our user’s information with the highest care. We are CASA certified and GDPR compliant.

We use 128-bit encryption and have robust controls to ensure that all user data is protected and secure. Our detailed efforts on security and compliance can be viewed via Security at Mesha .

Q6. Mesha is designed for a wide audience—from founders to freelancers to small businesses. What challenges do each of these user groups face, and how does Mesha address these specifically?

Tahem Verma: Mesha caters to a diverse audience by addressing the unique challenges each user group faces in managing accounts receivable efficiently.

- Founders: Often juggling multiple responsibilities, they need streamlined processes to free up time for strategic decisions. Mesha automates invoicing, follow-ups, and reconciliation, reducing their workload and ensuring steady cash flow.

- Freelancers: Frequently facing cash flow issues due to delayed payments, freelancers benefit from automated reminders and integrations with payment platforms, helping them get paid faster without awkward follow-up emails.

- Small Businesses: Dealing with higher invoice volumes and complex client relationships, Mesha’s centralized client portal and integrations with popular tools allow them to manage multiple clients and invoices seamlessly, keeping financials accurate and cash flow consistent.

The goal with Mesha is to empower businesses to grow faster without having to worry about accounts receivables or invoicing.

Q7. Can you describe the role of Mesha as a productivity tool? How do features like automated follow-ups and a centralized client portal help users reclaim time and boost cash flow?

Tahem Verma: Mesha functions as a powerful productivity tool by automating the complex, time-consuming tasks associated with accounts receivable (AR) management. Its features, such as automated follow-ups, ensure that invoices are consistently addressed, reducing the likelihood of late payments and streamlining cash flow. Users can manage all client interactions, monitor outstanding invoices, and handle payments, which cuts down on the need to switch between platforms or manually track payment statuses. This efficiency enables users—whether they’re freelancers, small business owners, or founders—to reclaim valuable time and focus on growth-driving activities, all while optimizing cash flow through reliable, automated AR processes.

Q8. What is your vision for Mesha over the next few years? Are there new features or services in the pipeline to expand Mesha’s capabilities?

Tahem Verma: Yes, we plan to extend our products to the entire finance back office, automating 90% of all functions in the space.

Q9. How do you see Mesha positioned in the broader landscape of AI-powered business tools? What are the key differentiators that set Mesha apart in the automation and billing space?

Tahem Verma: A few key differentiators:

- We work with your existing finance stack and workflows. Our goal is to improve your operations, not replace your software.

- Our product can be human-assisted, enabling humans to stay in the loop for every step of the way if required.

- We built the product to serve our own needs, and thus it has been developed using data and insights from hundreds of customers.

Q10. Could you share a bit about your background and previous experiences? How have they shaped your approach to building Mesha and addressing pain points for other entrepreneurs?

Tahem Verma: I have started and exited a previous startup, helping it achieve scale. I used my learnings from building this startup to help shape Mesha. This includes:

- Hiring the best and empowering them to do their best work.

- Listening to users and delighting them.

- Shipping fast and constantly innovating.

Q11. What has been the biggest lesson learned in developing and launching Mesha? Any pivotal moments that influenced the current direction of the platform?

Tahem Verma: Always listen to your users! As we started developing the platform, speaking with users on a weekly basis helped us iterate and build for them.

Conclusion

Mesha is more than just a platform—it’s a solution to a universal problem faced by businesses worldwide. By automating the complexities of accounts receivable management, it frees up time, improves cash flow, and empowers users to focus on what truly matters: growth.

As Mesha continues to innovate and expand its capabilities, it’s clear that this AI-driven platform is paving the way for a more efficient and productive future in financial management. AIPressRoom is honored to share Mesha’s story and looks forward to its ongoing success.